What’s In this Article?

- 🍆Understanding the Basics of Sex Toy Tariffs

- 🌎Where Sex Toys Get Flagged: A Breakdown of Tariff Trouble

- 💵Myths, Moves, and Money-Saving Insider Tricks

- 💰Consumer Implications and Market Trends

- 🔮Future Outlook and Policy Considerations

- 🎯Want to Change the System? Here’s How to Start

- 🔚 Final Thoughts on Sex Toy Tariffs

- 🔎Want More Useful Articles?

Chainsaws and microwave ovens glide through customs with barely a fee. But import a box of vibrators, and suddenly you’re paying like it’s luxury contraband. Sex toy tariffs aren’t just real—they’re a bizarre intersection of outdated trade codes, cultural taboos, and economic blind spots.

Despite the global boom in sexual wellness, governments still treat sex toys as miscellaneous novelties—or worse, as health risks—slapping them with steep import duties, inconsistent HS code classifications, and enforcement rules that leave small businesses scrambling. If you’re a buyer, importer, or curious consumer, the hidden costs of these tariffs are probably affecting you more than you realize.

Here’s what you’ll find inside:

- Why HS codes for sex toys can make or break a shipment

- How U.S. and EU tariffs compare—and who’s paying more

- The strategies smart brands are using to dodge unnecessary fees

- What these tariffs mean for product pricing, availability, and access

- How advocacy groups are quietly pushing for reform

Let’s dig in.

🍆Understanding the Basics of Sex Toy Tariffs

“I listed it as a ‘personal massager’—customs called it a novelty, added 12% in tariffs, and held it for inspection. It was a $40 item.” — Independent U.S. retailer, 2024

Tariffs aren’t just a line item on a shipping invoice—they’re a gatekeeper. For sex toys, that gate is often unpredictable and disproportionately expensive.

Unlike other consumer electronics or health devices, sex toys rarely have a consistent HS (Harmonized System) code across countries. One product might be considered a “massage device” in the U.S., a “novelty item” in India, and a “medical appliance” in the EU. Each classification can trigger a completely different tax rate—sometimes from 3% to 18%, or even higher if additional duties apply.

Here’s the problem:

None of these categories were built for vibrators. The global trade system still treats sexual wellness as an edge case—if not a taboo. That creates massive confusion at ports, especially for small or mid-size brands without in-house legal help.

Let’s break down how a single misclassification can cost you:

- “Massage Apparatus” (HS 9019.10) → Often accepted, moderate tariffs

- “Medical Device” → Can reduce duty, but requires certifications

- “Novelty or Toy” → Higher tariff + risk of seizure or rejection

- “Miscellaneous Goods” → Catch-all that triggers full inspection

Small importers often roll the dice, hoping to avoid costly delays or reclassification. But if customs disagrees with your product description, you could face back-tariffs, fines, or product holds that last weeks.

So why does this matter to shoppers and brands?

Because every unclear tariff eats into profit, and that often trickles down as higher retail prices, fewer options, and slower access to innovation in the sexual wellness space.

👉 Up next: how different countries handle these classifications—and why the same dildo can cost more depending on which port it lands in.

🌎Where Sex Toys Get Flagged: A Breakdown of Tariff Trouble

Let’s look at how sex toy classification—and the cost—varies wildly depending on where it’s going.

| Country/Region | Average Tariff Rate | Classification Used | Red Flag Notes |

|---|---|---|---|

| United States | 3.4%–12.8% | “Massage apparatus,” “Other” | Often reclassified mid-shipment |

| European Union | 0%–6.7% | “Personal care item” | Low tariffs, but tight compliance |

| India | 18%–28% + GST | “Miscellaneous goods” | Treated as non-essential luxury |

| China (Export) | Rebates vary | “Medical device” or “Massager” | Incentives for bulk exporters |

| Australia | 0% (often exempt) | “Household electrical” | Some items flagged for obscenity check |

“We had a shipment of wands held in Mumbai for two weeks because customs wanted ‘clarity on intended use,’” one importer shared. “We had to submit demonstration videos. It was humiliating and completely unnecessary.”

Tariff classifications for sex toys remain wildly inconsistent across borders. In the U.S., they’re often filed under HS code 9019.10.20—“massage apparatus”—to avoid red flags, but even then, CBP has flagged and reclassified certain products mid-transit. That kind of reclassification can push tariffs into the double digits.

The EU tends to be more lenient, particularly under its wellness and health exemptions, but brands must comply with CE marking, labeling, and material disclosure laws. India, by contrast, applies steep luxury taxes and regularly detains shipments labeled as “adult goods,” especially if not supported by medical or wellness framing.

For sex toy businesses, this means the same product might be taxed at 0% in Berlin, 12% in New York, and rejected outright in Delhi. No wonder larger companies hire legal consultants just for tariff mitigation.

Policy-wise, none of this is static. Trade negotiations, local court rulings, and cultural shifts can all influence which classification a product gets, and what that product pays to cross the line.

💵Myths, Moves, and Money-Saving Insider Tricks

You might not see it on the packaging, but a ton of work goes into making sure your toy doesn’t get trapped—or taxed into oblivion.

“We didn’t touch the product. We just got the paperwork right. That change alone saved us $18,400 last quarter.”

— Logistics lead at Dame Products, 2024

Tariffs feel like a fixed cost—but that’s not entirely true. Smart brands are adapting, often behind the scenes, using legal, creative, and operational tools that aren’t obvious from the outside.

Let’s clear up some of the most common assumptions.

Myth: HS codes are just numbers—whatever customs assigns is final.

Reality: You can challenge and pre-set classifications.

- In the U.S., a Binding Ruling from Customs and Border Protection (CBP) locks your HS code before shipping.

- Brands like Crave and Dame regularly use this to prevent surprise fees or seizures.

Myth: You have to absorb the tariff or raise prices.

Reality: Country-of-origin rules can cut or erase duties.

- Free Trade Agreements (FTAs) with Mexico, Australia, and others allow tariff-free import if assembly occurs there.

- Some EU-based brands do final assembly in FTA countries just to qualify.

Myth: It’s too risky to reframe a product’s category.

Reality: Reframing is legal—if grounded in function.

- Pelvic floor wands labeled as “rehabilitative devices” often qualify for reduced duties.

- But it needs real-world backing—material specs, documentation, use-case clarity.

Myth: You need to go big to optimize.

Reality: Small tweaks can save thousands.

- One Berlin-based company cut seizure risk by 80% just by updating their invoice language to reflect intended use and body-safe materials.

- A custom broker flagged their original wording as “red flag language” in conservative ports.

Sex toy tariffs aren’t going away—but how you classify, label, and route your products can change how much they cost to move. The difference between a 6% and 18% duty often comes down to paperwork, not design. And the longer the system stays broken, the more that work matters—for your wallet and your pleasure.

💰Consumer Implications and Market Trends

Q: Why is my favorite vibrator suddenly $30 more—and out of stock for months?

Because sex toy tariffs don’t just hit brands, they hit you.

When tariffs raise costs upstream, you feel it downstream, whether you’re a casual buyer or a long-time pleasure product enthusiast. It’s not just price hikes, either. The ripple effect hits what’s available, how it’s marketed, and who even gets access.

Q: How much do tariffs actually impact prices?

A 2023 review by the Pleasure Product Trade Alliance found that tariffs added 5–15% to the end retail price of high-end toys, especially rechargeable and app-controlled models. Some smaller brands had to discontinue SKUs or shift production to less regulated countries, risking quality.

Q: What kinds of toys are most affected?

- Import-heavy brands with niche features or luxury materials

- Toys with built-in motors or Bluetooth controls (classified as electronics)

- Pelvic floor tools and wands—often trapped in medical vs. novelty gray zones

- Products shipped into conservative or high-tariff regions (e.g., India, parts of Africa)

Q: Why does availability change so suddenly?

Shipments can get held or rejected at customs if classification isn’t airtight. In the U.S., CBP has detained large orders for “further inspection”—which can mean weeks in limbo or complete loss. Some retailers now stagger releases or warehouse stock in multiple countries just to stay flexible.

Q: Who gets hit hardest by this?

- Low-income buyers, who rely on affordable, accessible toys

- LGBTQ+ and disabled communities, where specific toys serve health and identity needs

- Small, queer-led brands, which often lack legal teams or global fulfillment options

Sexual wellness is an $80B global industry, but until customs systems catch up, buyers will keep paying more—for less. Meaning, this isn’t just a business problem. It’s a pleasure-access problem.

🔮Future Outlook and Policy Considerations

“The problem isn’t just the tariffs—it’s that the trade system treats pleasure as a joke. Until that changes, sex toys will always be fighting for legitimacy.”

— Policy analyst, International Sexual Health Coalition

Tariffs don’t exist in a vacuum. They’re shaped by politics, public perception, and who gets to decide what qualifies as “essential.” And when it comes to sex toys, that decision has rarely included the people who use them—or the communities that rely on them.

A few shifts already underway:

- Lobbying from major brands like Dame and We-Vibe has pushed regulators to reconsider how sex toys are classified—especially in the U.S. and EU.

- Legal reclassifications are gaining traction. In 2024, a Canadian court ruled that vibrators with pelvic rehab use can qualify as “medical devices,” which slashed duties by 80%.

- Public health orgs are starting to speak out. The World Association for Sexual Health released a position paper supporting trade reform for therapeutic sex tech.

But the push for reform isn’t just bureaucratic—it’s cultural.

Tariffs will continue to reflect global attitudes about sexual health, disability, gender equity, and bodily autonomy. Until regulators stop framing sex toys as “toys,” policies will lag behind both science and demand.

Still, change is happening—just not evenly. Some countries are revising tariffs downward. Others are doubling down, especially where sexual expression is still criminalized or stigmatized.

So where does change come from—and who’s already pushing?

That depends on advocacy, transparency, and whether the pleasure industry keeps pushing to be seen as valid, valuable, and deserving of legal clarity.

🎯Want to Change the System? Here’s How to Start

Whether you’re a curious buyer, a community advocate, or someone who just wants their favorite toy back in stock, there are ways to push for change, without being an expert on trade law.

Here’s how to start:

✅ 1. Track classification rulings

Customs decisions aren’t always publicized, but they set a precedent. Check the U.S. Customs Rulings Online Search System (CROSS) to see how sex toys are being labeled and taxed in real time.

✅ 2. Support brands challenging trade norms

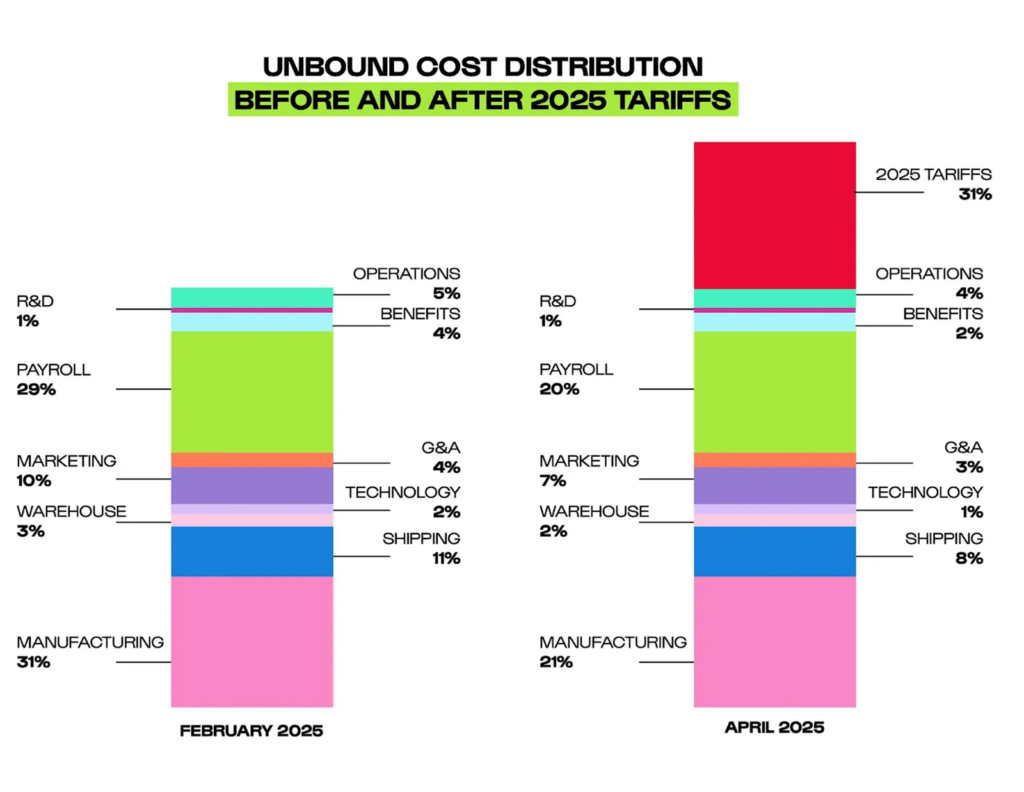

Companies like Dame, Crave, and Unbound have fought legal battles just to get sex toys treated fairly. Buying from these brands supports both quality design and long-term policy change.

✅ 3. Follow sexual health policy groups

Stay updated via organizations doing the legal and cultural legwork:

- World Association for Sexual Health (WAS)

- National Coalition for Sexual Freedom (NCSF)

- Free the V (UK-based tariff equity campaign)

✅ 4. Contact your trade or customs office

If you’re a small business or distributor, request a Binding Tariff Information (BTI) decision from your country’s customs agency. It’s your right—and it protects you from arbitrary fees later.

✅ 5. Talk about it—loudly and clearly

Pleasure isn’t trivial. Tariff policy reflects public values, and silence keeps stigma alive. Share stories, challenge euphemisms, and normalize the language of sexual wellness in professional spaces.

Your orgasms shouldn’t be collateral damage in a broken policy system.

🔚 Final Thoughts on Sex Toy Tariffs

Sex toy tariffs might seem like just another layer of bureaucratic nonsense—but for millions of people, they shape access to care, connection, and pleasure. Whether you’re shopping for your first wand or waiting weeks for your favorite brand to restock, you’re already living with the effects of trade systems that weren’t built with your body—or your rights—in mind.

This isn’t just about taxes on toys. It’s about who gets to feel good, who gets priced out, and who gets left behind when policymakers treat pleasure as an afterthought.

So talk about it. Ask questions. Share the article. Ask your favorite brand how they’re navigating it.

Because every vibrator caught in customs is a reminder that your pleasure still isn’t treated as essential.

And it should be.

👉 Looking for compliant and quality-assured pleasure products? Explore Lovesen’s curated collection designed to navigate the complexities of long-distance relationships.

🔎Want More Useful Articles?

- How to Save Money on Sex Toys: Up to 50% Off with Lovense Tips & Discount Codes

- The Ultimate Guide to Scoring Free Sex Toys: Insider Tips and Tricks

- Long-Distance Relationship Gifts Guide: Sending Love From Afar